Fintech or Financial technology is the use of technology in designing and delivering financial products or services faster and cheaper.

According to a LinkedIn report, 10% of Singapore’s startups are in the FinTech arena, making fintech the buzzword for the city-state.

Singapore also recently organized the world’s largest FinTech Festival which was attended by a host of dignitaries from around the world like heads of states Justin Trudeau (Canada), Narendra Modi (India) and institution heads like Christine Lagarde (IMF) among others, where it was agreed that FinTech is the future of finance.

“A new wind of digitalization is blowing and money itself is changing. We expect it to become more convenient and user-friendly, perhaps even less serious-looking.”- Christine Lagarde

FinTech has also allowed commerce to transcend physical boundaries with minimal or no currency conversion fees, this report by AsiaOne is an example.

Like any field, economic activity and finance are also being revolutionized by digitization. We are not only seeing economic processes being automated, but the shrinking role of cash and newer forms of currency are challenging the way we transact business.

Singapore with its unique demography is just the best mushrooming ground for FinTech startups and here’s why:

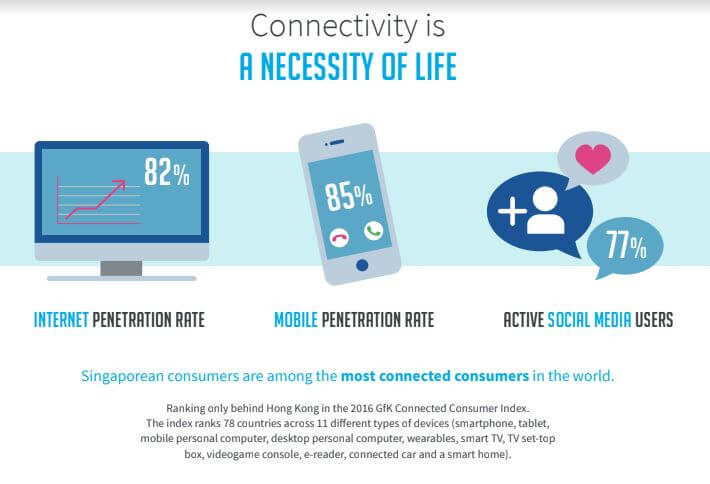

The rise of Mobile and Mobile Apps

Not only are organizations aware of the fact that mobile is the future of everything but are also investing in various mobile apps which offer FinTech solutions.

Image source: LinkedIn

Image source: LinkedIn

Here are some examples:

Singapore-based ‘fastacash’ provides a global social payments platform that allows users to transfer money along with photos, messages, or videos, through the social network via a secure link.

MoolahSense, Singapore’s first crowd-financing platform aims to connect established businesses seeking loans for capital expansion, purchases, or other needs to the investor community.

TOAST is a Peer 2 Peer money transfer app that allows people in Singapore, and Hong Kong to remit money back home directly from a smartphone without the need for banks.

These are just a few from the ever-growing list.

As cash-based transactions are decreasing daily, enterprises in Singapore are opting to have their business run through an app.

With options of API integration, biometric authentication, and higher flexibility, mobile apps have become the platform for the flourishing fintech space.

Fintech has served a lot of purposes: It has helped to make digital transactions faster, less cost-intensive, and above all transparent.

While we can’t say for sure if the era of Fintech apps will make banks obsolete completely in the future, we surely believe that FinTech is here to say and the time is ripe to make forays into the sphere.